As industries worldwide increasingly pivot towards sustainable practices, the necessity for effective risk management strategies in commodities trading has intensified. This need is particularly pronounced in the context of circular economies, where the emphasis on waste reduction and the utilization of secondary raw materials poses unique challenges and opportunities. Hedging, a fundamental financial strategy used to manage risk and stabilize pricing, plays a pivotal role in this dynamic. This article explores how hedging in commodities is not just a financial tool but a vital component in the broader context of achieving circularity and low emissions, as outlined in the EU funded ambitious Horizon Europe project DigInTraCE (Grant Agreement No. 101091801) in which Hypertech proudly participates. In this article we explore the role of hedging in circular value chains as viewed within the DigInTraCE project and discuss the related challenges.

Understanding Hedging in Commodities

Hedging involves taking a position in a market, typically through derivatives like futures, options, or swaps, to offset potential losses in another position. For companies involved in the commodities market, particularly those dealing with raw materials necessary for manufacturing, hedging is crucial. It provides a buffer against the volatility of commodity prices, which can be influenced by a variety of unpredictable factors such as weather conditions, political instability, and market fluctuations.

The Role of Hedging in Circular Economies

The DigInTraCE project, aiming to integrate a digital value chain traceability framework for process industries, emphasizes circularity and low emissions by minimizing waste and using secondary raw materials. In such a setting, hedging becomes not only a tool for financial stability but also for operational continuity. By locking in prices for raw materials, companies can avoid the cost fluctuations that might otherwise occur due to varying availability of recycled or secondary materials. This stability is essential for long-term planning and investment in processes that prioritize sustainability over short-term gains.

Case Study: Wood Chip Recycling Industry

Consider the wood chip recycling industry, a crucial component in various manufacturing processes such as paper production and bioenergy. The price of wood chips can fluctuate significantly due to factors like changes in forestry management practices, environmental regulations, and shifts in demand for biofuel. Companies that engage in hedging can manage the financial risks associated with these fluctuations. By securing price points through futures contracts or options, they ensure a consistent cost base despite the volatile market, allowing them to plan and execute sustainable practices more effectively.

Hedging Example: Hedging Wood Chips Using Options

To illustrate how hedging can be effectively applied using options, consider a company that manufactures wood-based products and relies heavily on wood chips as a primary raw material. Wood chips can exhibit significant price volatility due to factors like changes in forestry regulations, seasonal fluctuations, and overall market conditions in the timber industry.

Scenario:

A hypothetical company, "XYZ Industries," specializes in creating wood-based products and uses a substantial amount of wood chips. The price volatility of wood chips could significantly impact their production costs. To manage this risk, XYZ Industries decides to employ a hedging strategy using options.

Hedging Strategy:

XYZ Industries opts to use call options to hedge against the potential rise in wood chip prices. This strategy involves purchasing call options, which give XYZ Industries the right, but not the obligation, to buy wood chips at a predetermined strike price before the options expire.

Wood Chips Call Options: XYZ Industries purchases call options for wood chips with a strike price slightly above the current market price, expiring in six months. If the price of wood chips increases beyond the strike price during this period, the value of these options will rise, providing financial relief against the increased raw material costs.

Implementation:

Monitoring and Execution: XYZ Industries actively monitors market conditions and prices for wood chips. If the prices rise and surpass the strike prices of their options, the company can exercise the options to purchase the wood chips at these predetermined prices, thereby mitigating the impact of higher raw material costs.

Flexibility and Adjustment: The use of options provides flexibility. If the prices do not exceed the strike prices, the company may choose not to exercise the options, losing only the premium paid for these options but avoiding higher costs than the current market prices.

Benefits:

Using options allows XYZ Industries to manage its exposure to price increases while maintaining the flexibility to react to market conditions. This strategic approach helps stabilize production costs, even when external economic factors cause raw material prices to fluctuate significantly.

This example of hedging using options for wood chips demonstrates how companies can protect themselves against price volatility in critical raw materials while maintaining operational flexibility and financial predictability.

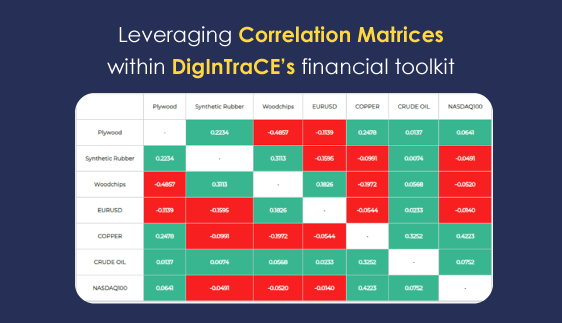

Hedging Strategies and Digital Traceability

One of the innovative aspects of the DigInTraCE project is the incorporation of digital traceability into the supply chain. This integration provides a clear insight into the origins and movements of secondary raw materials. With advanced analytics, firms can predict shortages or surpluses of materials and adjust their hedging strategies accordingly. For example, if data indicates a potential surplus of recycled wood chips, manufacturers can hedge against a price drop, securing a higher sale price ahead of market changes.

Challenges and Considerations

While hedging offers numerous benefits, it is not without its challenges. The primary concern is the cost of setting up and maintaining effective hedging strategies, which includes transaction fees and the need for specialized knowledge in financial markets. Furthermore, the effectiveness of hedging is contingent on the accuracy of market forecasts and the availability of suitable financial instruments that align with the specific needs of circular industries.

Policy and Regulatory Framework

To foster an environment where hedging can effectively support circular economy goals, policy and regulatory frameworks need to be adaptive and supportive. The EU, through projects like DigInTraCE, can play a crucial role by facilitating discussions among financial regulators, commodity markets, and industries transitioning towards circularity. This collaborative approach can help tailor financial instruments that are both economically viable and environmentally sustainable.

Conclusion

Hedging, in the context of commodities, is an indispensable strategy for many industries. By providing financial stability and reducing exposure to price volatility, hedging enables companies to commit to environmentally sustainable practices without compromising economic viability. As we advance, the integration of hedging strategies with digital traceability will be crucial in fine-tuning the balance between economic efficiency and environmental responsibility in the process industries. This strategic alignment is not just beneficial but essential for the success of a circular economy.

Disclaimer: Views and opinions expressed are those of the author(s) only and do not necessarily reflect those of the European Union or HADEA. Neither the European Union nor the granting authority can be held responsible for them.