As markets for secondary raw materials continue to evolve, the importance of robust technical analysis tools for predicting price movements and managing risk becomes increasingly significant. Technical indicators such as MACD, RSI, EMAs, Bollinger Bands, and DMI provide traders and analysts with critical insights into market trends, enhancing the ability to make informed trading decisions. This article explores how these technical indicators are not just financial tools but vital components in the broader context of achieving circularity and low emissions, as outlined in the EU-funded ambitious Horizon Europe project DigInTraCE (Grant Agreement No. 101091801) in which Hypertech proudly participates. In this article, we explore the role of these technical indicators in the trading of secondary raw materials and discuss their applications, benefits, and implications.

Understanding Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or other features of the financial assets. These indicators help traders identify patterns and trends in market behavior, enabling them to forecast future price movements. The selected technical indicators—MACD, RSI, EMAs, Bollinger Bands, and DMI—cover all the key aspects of technical analysis: trend identification, momentum measurement, volatility assessment, and strength of price movements. The key technical indicators discussed here include:

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

- Exponential Moving Averages (EMAs)

- Bollinger Bands

- Directional Movement Index (DMI)

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a material's price. It is calculated by subtracting the 26-period EMA from the 12-period EMA. The result of this calculation is the MACD line. A nine-day EMA of the MACD, called the "signal line," is then plotted on top of the MACD line, which can function as a trigger for buy and sell signals.

Application in Secondary Raw Materials: Traders use the MACD to identify potential buy and sell points by looking for crossovers, divergences, and rapid rises or falls. For example, in the market for recycled plastics, a MACD line crossing above the signal line may indicate a bullish trend, suggesting a good entry point for traders.

Relative Strength Index (RSI)

The RSI measures the speed and change of price movements. It oscillates between 0 and 100 and is typically used to identify overbought or oversold conditions in a material.

Application in Secondary Raw Materials: An RSI above 70 indicates that a material might be overbought, while an RSI below 30 suggests it might be oversold. For instance, if the RSI for recycled aluminum is above 70, traders might consider selling, anticipating a price correction.

Exponential Moving Averages (EMAs)

EMAs place more weight on recent prices, making them more responsive to new information. The commonly used periods for EMAs are 20, 50,100 and 200 days.

Application in Secondary Raw Materials: EMAs help traders identify the direction of the trend. For example, in the market for a type of wood, a 50-day EMA crossing above the 200-day EMA might be seen as a bullish signal, prompting traders to enter long positions.

Bollinger Bands

Bollinger Bands consist of a middle band (a simple moving average), an upper band, and a lower band. The bands expand and contract based on market volatility.

Application in Secondary Raw Materials: Bollinger Bands are used to gauge market volatility and identify overbought or oversold conditions. For instance, if the price of recycled steel moves above the upper Bollinger Band, it might indicate that the material is overbought, signaling a potential sell.

Directional Movement Index (DMI)

The DMI helps determine the direction of a price trend by comparing the highs and lows over a specified period. It consists of two lines, +DI and -DI, and the Average Directional Index (ADX).

Application in Secondary Raw Materials: The DMI is used to assess the strength of a trend. For example, in the market for recycled paper, a high ADX value combined with the +DI line above the -DI line suggests a strong upward trend, guiding traders to maintain or enter long positions.

Hedging in Secondary Raw Materials Markets

Hedging is a fundamental risk management strategy used to protect against price volatility in the secondary raw materials market. It involves taking a position in a market, typically through derivatives like options, to offset potential losses in another position. This strategy is crucial for companies dealing with secondary raw materials, as it helps stabilize pricing and ensures continuity in supply chains. For example, a company that relies heavily on recycled woodchips for production can use options to hedge against price fluctuations. By locking in a price for future delivery through options, the company can protect itself from adverse price movements that could impact its cost structure and profitability.

Options come in two primary forms: call options and put options. A call option gives the buyer the right, but not the obligation, to purchase a commodity at a specified price within a certain time frame. Conversely, a put option gives the buyer the right, but not the obligation, to sell a commodity at a specified price within a certain time frame.

Technical analysis plays a vital role in hedging by providing traders with insights into market trends and potential price movements. By using indicators such as MACD, RSI, EMAs, Bollinger Bands, and DMI, traders can better time their hedging activities and optimize their strategies. For instance, when technical indicators suggest a potential price increase in recycled woodchips, a company might decide to enter into futures contracts sooner to lock in lower prices. Conversely, if indicators signal a possible price drop, the company could delay its hedging activities or choose different financial instruments, such as put options, to benefit from the expected decline. This informed approach to hedging, guided by technical analysis, helps companies manage risk more effectively and maintain financial stability in volatile markets.

Case Study: Using Technical Indicators and Hedging in the Recycled Woodchips Market

Consider a trading firm specializing in recycled woodchips. By integrating technical analysis with hedging strategies using options, the firm can make informed decisions to mitigate risks associated with price volatility in the recycled woodchips market. Here’s how the firm applies this logic:

• Anticipating Price Increases: When technical indicators, such as MACD and EMAs, suggest a bullish trend, the firm hedges by purchasing call options to secure the right to buy at current prices. This protects the firm from paying higher prices in the future.

• Protecting Against Price Drops: If indicators like RSI and Bollinger Bands signal overbought conditions or potential price reversals, the firm might use put options to hedge against price drops. This ensures they can sell woodchips at a predetermined price, mitigating potential losses.

• Managing Volatility: By using Bollinger Bands and DMI, the firm can assess market volatility and trend strength. This helps in adjusting the hedging strategy dynamically—buying call or put options based on market conditions and the strength of the trend.

Through this approach, combining technical analysis with strategic hedging using options, the trading firm can effectively navigate the complexities of the recycled woodchips market, ensuring financial stability and optimizing profitability amidst market fluctuations.

Challenges and Considerations

While technical indicators provide valuable insights, they are not infallible and should be used in conjunction with other analysis methods. The primary challenges include:

• False Signals: Indicators can sometimes generate false signals, leading to incorrect trading decisions.

• Lagging Nature: Many indicators are based on historical data and may lag behind real-time market movements.

• Market Conditions: Indicators may perform differently under varying market conditions, requiring traders to adapt their strategies accordingly.

Integrating Technical Indicators into DigInTraCE: Enhancing Risk Management and Decision-Making in the Secondary Raw Materials Market

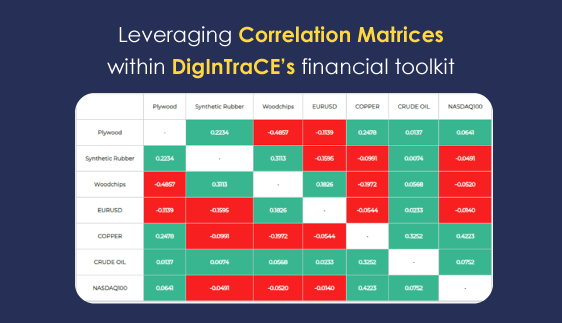

The DigInTraCE project aligns closely with the use of technical indicators in the financial markets for secondary raw materials, as it emphasizes the importance of data-driven decision-making to enhance market stability and predictability. By integrating tools such as MACD, RSI, EMAs, Bollinger Bands, and DMI into its decentralized traceability platform, DigInTraCE’s financial toolkit can provide stakeholders with crucial insights into market trends and price movements. This not only facilitates more informed trading decisions but also strengthens risk management strategies through dynamic hedging. For example, DigInTraCE’s financial toolkit strategies can leverage these indicators to help companies optimize their hedging strategies, predict price trends more accurately, and better manage price fluctuations for secondary raw materials like recycled plastics or wood. By incorporating technical analysis into its decision-making framework, DigInTraCE financial toolkit helps market participants navigate the complexities of trading in a volatile and interconnected global market, aligning with its broader mission of fostering circularity, sustainability, and economic resilience in the secondary raw materials sector.

Conclusion

Technical indicators such as MACD, RSI, EMAs, Bollinger Bands, and DMI are indispensable tools in secondary raw materials markets. They provide traders with a framework for analyzing market trends, predicting price movements, and making informed trading decisions. By integrating these indicators into their trading strategies, traders can enhance their ability to navigate the complexities of the market, mitigate risks, and capitalize on opportunities. Additionally, combining technical analysis with hedging strategies using options can further protect against adverse price movements. Hedging allows traders to lock in prices or secure the right to buy or sell at predetermined levels, thereby stabilizing costs and ensuring continuity in supply chains. As with any trading tool, the key to success lies in continuous learning, adaptation, and combining technical analysis with other forms of market research and hedging techniques.

Disclaimer: Views and opinions expressed are those of the author(s) only and do not necessarily reflect those of the European Union or HADEA. Neither the European Union nor the granting authority can be held responsible for them.